Speaker Bios

Natasha Alexeeva, CEO, Friendly Inc.

Natasha Alexeeva is a product and technology leader with deep expertise at the intersection of insurance and AI. She has spent over a decade building and scaling complex platforms, leading high-impact teams at companies including Visa, Kaiser Permanente, and Amazon. For the past six years, Natasha has focused on designing and delivering AI-powered solutions for insurers and brokers, helping modernize underwriting, distribution, and operations. She is known for pairing strong technical judgment with a sharp understanding of regulated industries, turning emerging technology into practical, revenue-driving products that actually work in the real world.

Mitch Anderson, Owner, Rochester Senior Solutions

Mitch Anderson is a licensed insurance agent specializing in the Medicare market and owner of Rochester Senior Solutions, Inc. based in Minnesota. He has a proven track record of success in helping clients navigate the complexities of Medicare and find plans that meet their needs. Recently, Mitch has expanded his practice to include annuity sales, offering clients a more comprehensive suite of retirement planning solutions.

David Baer, President, Nomo Smart Care

David Baer is an accomplished business leader and award-winning attorney with expertise in corporate and business law. Known for strategic vision and leadership, he excels in entrepreneurial settings. As President of Nomo Smart Care, David leads the company in developing and marketing innovative, privacy-first AI solutions for elderly monitoring and remote caregiving, empowering independent living and providing peace of mind to families. With experience as an attorney at Stinson, COO and General Counsel for two diverse holding companies, and an owner of successful businesses, he leverages his MBA to tackle complex challenges. Recognized as a Minnesota Rising Star by Minnesota Law and Politics and one of Minnesota Lawyer's 15 Attorneys of the Year, he is adept at driving results and building strategic relationships.

Calvin Bagley, Founder & President, Nuvo Health & The Medicare Store

Calvin Bagley is the founder of Nuvo Health, a national Field Marketing Organization that has facilitated over 75,000 enrollments. A respected industry advocate, Calvin has met with CMS multiple times and engaged with more than a dozen members of Congress on Medicare policy. He authored a comprehensive response to the CMS 2027 Final Rule and is a sought-after speaker on industry reform. Calvin is also an Amazon bestselling author of Hiding from the School Bus, a memoir about overcoming childhood adversity. He lives in Las Vegas with his wife and two children, and has traveled to all 50 states and seven continents.

Renée Balcom, CEO & Founder, Scroll.care

Renee Balcom is the Founder & CEO of Scroll.care, Inc., a technology-driven marketplace redefining how families access care services across the continuum—from Medicare navigation to home care, advocacy, and beyond. With a background in distribution strategy and broker partnerships, she launched Scroll.care to bridge the widening gap between insurance enrollment and real-world care coordination. Her work centers on integrating AgeTech with human-centered service, empowering brokers to expand their value while ensuring families receive vetted, trusted support. Renee is a bold advocate for modernizing care access and believes technology should enhance—not replace—the humanity at the heart of healthcare.

Michelle Barbeau, CRO, eHealth

Michelle Barbeau is Chief Revenue Officer at eHealth, a leading private online health insurance marketplace. In this role, she helps set the company’s strategic direction, overseeing growth, customer acquisition, loyalty, brand, marketing, business development, data science, and analytics. She joined eHealth in 2022 as Chief Marketing Officer, helping launch the company’s award-winning brand campaign. Ms. Barbeau holds a B.A. in International Business and Spanish from Gustavus Adolphus College and an M.B.A. in Marketing from the University of Minnesota — Carlson School of Management. She is completing the Chief Revenue Officer Executive Program from the Wharton School of the University of Pennsylvania.

Arthur Barlow, President & CEO, Compass Insurance Advisors

Arthur Barlow is the CEO and Co-Founder of Compass Insurance Advisors. Compass supports its 450+ agents in helping individuals, families, and businesses find the right solutions for HEALTH, MEDICARE, GROUP, and LIFE Insurance products. Arthur has been in the insurance space for over 13 years and is hoping to help lead the ACA industry to a more stable and transparent experience for the consumer and the agent.

Annette Bechtold, Leadership & Executive Coach, Forte Consulting Atlanta

Annette Bechtold, PCC, CPLC, REBC, ChHC, CIC, is a leadership and executive coach, consultant, and founder of Forte Consulting Atlanta. With over 40 years in the insurance industry, she brings deep expertise in operations, compliance, and benefits strategy. Annette has held numerous local, state, and national leadership roles with NABIP and continues to serve on key industry boards and councils. She partners with employers, insurance professionals, and organizations to grow leadership capacity, engage teams, and align performance with purpose. A nationally recognized advocate and speaker, Annette has been honored with NABIP’s highest awards. Fun fact: Her first job was supporting an independent agent at age 15 — and she’s been helping others thrive ever since.

Ori Ben-Yishai, Partner, Viewpoint Ventures

Ori Ben-Yishai is a Partner at Viewpoint Ventures, where he serves on the Investment Committee and leads the firm’s strategic insurance relationships. He spent 15 years in senior operating, marketing, and strategy roles at major carriers, including Global Chief Marketing Officer at Chubb and Chief Operating Officer of the Group Retirement division at AXA Equitable. Earlier in his career, Ori was an Engagement Manager at McKinsey & Company, a corporate and M&A attorney, and the founder and CEO of an eCommerce startup.

Robert Berg, President, Medicare Sales, MedCARE Health Advisors

A decorated U.S. military veteran, holding a degree in Aviation and a deep passion for service. As President of Medicare Sales at MedCARE Health Advisors, he leads a nationwide team focused on delivering exceptional healthcare solutions. With extensive experience in veteran healthcare, Robert is a recognized expert in helping veterans navigate the complexities of Medicare, TRICARE for Life, CHAMPVA, and VA benefits. His mission-driven approach and grassroots engagement have made him a trusted voice in the industry. Robert continues to champion better access, education, and advocacy for our nation’s heroes through innovative Medicare strategies.

Gregory Berger, Partner, Oliver Wyman

Greg is a Partner in Oliver Wyman’s Health and Life Sciences practice, within the government programs franchise (Medicare, Medicaid and ACA). His expertise is primarily around driving end-to-end P&L management for Medicare Advantage, Prescription Drug Plan (PDPs), Special Needs Plans (SNPs), and Medicare Supplement plans. Greg’s work is primarily for health plans to drive top-line growth for via key performance levers such as product / portfolio design, sales & marketing, risk adjustment, and Stars. He also has extensive experience in cost management approaches, including network design, payer-provider partnerships and clinical strategies. Greg lives in New York City, and holds an MBA in Health Care Management from the Wharton School at the University of Pennsylvania, and a B.A. from Dartmouth College.

Mark Bertolini, CEO, Oscar Health

Mark T. Bertolini is Chief Executive Officer of Oscar Health, a leading healthcare technology company. He is a national healthcare thought leader who has transformed the industry through innovation, accessibility, and affordability. Mark is former Co-CEO of Bridgewater Associates, the world’s largest hedge fund. Previously, he was Chairman and CEO of Aetna, where he led its transformation into a consumer-focused, integrated healthcare company. Following CVS Health’s acquisition of Aetna, he served as Director of CVS Health Corporation. He is Chairman of Verizon’s Board of Directors and serves on the boards of Thrive Global and the FIDELCO Guide Dog Foundation.

Curt is the CEO of Aproove, a platform that helps Medicare organizations streamline how marketing communications are created, reviewed for compliance, and approved. Under his leadership, Aproove focuses on automating collaboration through configurable workflows and accelerating approvals process with AI—while maintaining full HIPAA security, content gating, and complete auditability. Aproove reduces manual effort, validates communications against CMS requirements, and ensures every asset moves through a secure, trackable review process. Curt is passionate about giving Marketing and Product teams meaningful time back so they can focus on higher-value work while improving compliance accuracy across their organizations.

Michael Blea, Chief Growth Officer, SCAN Health Plan

As Chief Growth Officer for SCAN health plan, Michael Blea leads sales strategies across all markets and distribution channels. Throughout his 25-year career in leading successful growth and expansion initiatives, Michael has motivated sales teams at organizations including United HealthCare/Secure Horizons, Alignment Healthcare and Golden Outlook to achieve goals in highly competitive markets. Most recently, at Golden Outlook Michael was instrumental in market expansion and broker recruitment and engagement.

Isaac Bledsoe, Director of Strategic Projects & Initiatives, U.S. Department of Health and Human Services

Isaac M. Bledsoe is Special Agent in Charge of HHS-OIG's Miami Field Office. Beginning his law enforcement career nearly 20 years ago with the Air Force Office of Special Investigations, he reached Captain before joining HHS-OIG's Tampa Field Office in 2010, leading investigations yielding approximately $1 billion in recoveries and over 190 years of sentences. At OIG Headquarters, he directed Strategic Projects and Initiatives, overseeing DOJ Strike Force Operations, Medicare Part C, and Refugee Resettlement programs.

Isaac is a graduate of OI's Leadership Development Program and recipient of numerous awards including the Inspector General's Bronze Medal. He holds a Bachelor's in Criminology from Florida State University and Master's in Family, Youth & Community Sciences from the University of Florida.

Shawn Bloom, CEO, National PACE Association

Shawn Bloom is the President and CEO of the National PACE Association (NPA). Shawn has been with NPA since 2000 at which time there were 18 PACE organizations operating in 6 states. Currently, there are 181 PACE organizations in 32 states serving approximately 85,000 individuals. Prior to NPA, Shawn spent 5 years as the Executive Director of the Missouri Association of Homes for the Aging (MoAHA), which represented not-for-profit long-term health care and housing facilities in the state of Missouri. Shawn previously worked in the Policy and Governmental Affairs Division of the American Association of Homes and Services for the Aging (AAHSA) – now called Leading Age-- a Washington, D.C. based trade association that represents not-for-profit long-term health and housing services for the aging. Shawn has testified before the U.S. Congress, state legislative committees as well as the National Academy of Sciences on elderly and long-term care policy issues. Shawn received his B.S. in biochemistry and gerontology from Kansas State University and completed his Masters coursework in long term care at the University of North Texas, Center for Studies in Aging. Shawn began his career in the field working as a nursing home Certified Nurse Aide in high school and college.

Jonathan Bodwell, Owner, Bodwell Insurance Solutions

Founder and 20-year owner of Bodwell Insurance Solutions, I’ve

built a career rooted in integrity, service, and results. A proud

graduate of West Virginia University, I’m also a passionate sports fan

and devoted father to three grown children. I have personally served

thousands of clients and now find fulfillment in teaching and coaching

fellow insurance agents, helping them unlock their full potential and

succeed in a competitive industry. With decades of experience and a

commitment to excellence, I strive to lead by example—both in business

and in life—while staying true to the values that shaped my journey

from the start.

Diane Boyle, SVP, Government Relations, NAIFA

Diane R. Boyle is the senior vice president of government relations for the National Association of Insurance and Financial Advisors. Her responsibilities include developing and implementing NAIFA's comprehensive state, interstate, and federal legislative and regulatory strategies and daily executing association activities to provide advocacy services for insurance and financial professionals to support a private, competitive insurance marketplace. She serves as NAIFA’s chief federal lobbyist specializing in tax legislation focused on life and health insurance products, workplace benefits, pensions, and small business issues. Boyle is a proud Capitol-level contributor to IFAPAC and works closely with the political affairs team to develop strategies and programs to maximize NAIFA’s grassroots efforts around the country.

Jeremy Boz, Partner & SVP of Broker Development, Tyler Insurance Group

Jeremy Boz is Partner and Senior Vice President of Broker Development at Tyler Insurance Group. He leads broker growth, training, and carrier partnerships with a simple focus: serving clients and helping them find the right Medicare coverage. Under his leadership, TIG operates in 50 states and supports over 300 producing brokers, delivering thousands of new enrollments each year with industry-leading retention. Jeremy holds a B.S. in Marketing from SUNY Old Westbury and an MBA in Marketing from UNLV. He and his wife, Luciana, live in Las Vegas with their two children.

Doug Bradt, Regional VP, Broker Channel, HealthSpring

I am a Regional Vice President for HealthSpring Supplemental Benefit Sales, Broker Channel. I am responsible for engaging sales distribution to drive sales, strategy and grow results for the HSB product portfolio. I joined Cigna (HealthSpring) in December 2021 and prior was the National Director of Broker Engagement for the Humana. I have over 25 years’ experience in the senior market space with an emphasis on agent development, training and sales. He holds a BS degree in Communications from Old Dominion University and resides with his family in Hilton Head, SC.

Susan Bratton, CEO & Founder, Savor Health

Susan Bratton is Founder and CEO of Savor Health and a veteran healthcare, insurance, and finance executive. After nearly two decades on Wall Street advising healthcare companies on mergers, capital raising, and restructuring, she launched Savor Health following the loss of a friend to glioblastoma. Her company delivers AI-driven precision nutrition that personalizes guidance and improves outcomes for people with chronic disease, working with leading cancer centers, insurers, and pharmaceutical companies. A published researcher, cookbook author, and award-winning innovator, Bratton advocates making nutrition a standard of care through evidence, accessibility, and measurable impact. She speaks globally on food as medicine.

James Brenneis, Owner, Trinity Insurance Partners

I work with life and health agents nationwide, empowering them to cross-sell from a focused insurance foundation. My primary mission is helping health-focused agents and agencies confidently offer life and annuity products to their existing clients. As an active agent licensed since 2005, I stay closely connected to real client needs. I began in life insurance, expanded into health products in 2020, and now bridge both worlds to help agents serve seniors more effectively. I leverage technology and systematic processes to scale impact and encourage agents to step beyond their comfort zones to grow.

Amanda Brewton, Owner, Medicare Answers Now

Amanda Brewton is the founder of Medicare Answers Now, a national FMO supporting over 350 agents. With 18+ years in the Medicare industry, she focuses on strategic growth, compliance, and real-world education—without relying on recruitment tactics. Amanda serves on NABIP’s Medicare Advisory Group, contributed to the Medicare & You handbook, and leads national events including Ms. Medicare, Medicare & Margaritas, and is the Creative Director for the Agent Symposium at Medicarians. She has also been recognized as Educator of the Year and 2025 Momentum Maker, she is committed to raising industry standards and equipping agents to serve with integrity, clarity, and purpose.

Justin Brock, CEO & Founder, Brock

Justin Brock is a transformative figure in the Medicare and health insurance industry, known for his expertise, innovation, and commitment to helping both consumers and agents navigate the complex world of insurance. From a start in 2014, after nearly a decade in the Marine Corps, Justin quickly recognized the immense opportunity to improve how Medicare is marketed and delivered. With a unique mix of grit and creativity, he scaled BROCK into a nationally recognized Agency and FMO, helping over 150,000 Medicare customers in 202 and earning a spot on the Inc. 5000’s list of fastest-growing companies.

Josh Brooker, CVO & Co-Founder, SnapHealth

Joshua Brooker is the Chief Visionary Officer of SnapHealth and a recognized expert in ACA/U65 markets, including federal and state-based exchanges, as well as ICHRA. With over 15 years in the health insurance industry and a background in finance, he analyzes policy impacts combining macroeconomic trends with frontline experience. He advocates for smart solutions that improve access to affordable care. As Chair of NABIP’s Individual Markets Working Group, he also serves on PENNIE’s Advisory Council, is active with HAFA, and collaborates with CMS/CCIIO. His insights have been featured in The Wall Street Journal, Associated Press, Kaiser Health News, NPR, U.S. News, and Investopedia.

Tim Brousseau, SVP - Connexion Point & Managing Partner, Integrity

Tim Brousseau has over 20 years of health insurance sales, marketing and product experience. Tim’s health care career includes stops at a large, national carrier, a local Blue-plan, and 8+ years at Deft Research. He is currently a Managing Partner at Integrity and leading strategic and revenue growth for the health insurance focused BPO, Connexion Point. Tim brings industry knowledge and firsthand experiences to the table for all health insurance lines of business.

Jessica Brown, SVP, Marketing, AgentSync Inc.

Jessica Brown is Senior Vice President of Marketing at AgentSync, a leading insurtech company transforming how the insurance industry manages the agent experience through regulatory compliance and agent licensing. In her role, Jessica leads brand, demand generation, and market strategy, helping AgentSync scale its impact across carriers, agencies, and brokerages nationwide. With deep experience in B2B SaaS and insurtech, Jessica drives innovative go-to-market programs that illuminate how modern compliance and operations platforms reduce friction, improve efficiency, and accelerate growth for industry stakeholders. Her leadership is rooted in a commitment to customer-centric storytelling, cross-functional collaboration, and empowering teams to thrive. At AgentSync, Jessica champions initiatives that advance transparency, drive community learning, and elevate the role of innovation in insurance. She is a mom to a 9-year-old daughter and 8-year-old dog. You can find her cheering on her Philly sports teams with a passion!

Kevin Brown, FMO Principal, Wealth Alliance Group

Kevin Brown is the president of Wealth Alliance Group, a FMO based in Columbia, SC. Kevin founded Wealth Alliance Group with a mission of working with professional business partners in the Life and Health Insurance space to build wealth through strategic ventures. Prior to working in insurance, Kevin worked in corporate America with businesses that generated up to 10 million dollars in revenue annually. As a leader, he employs various strategies from his experience to help build and develop multiple agents and agency owners. When he’s not running the business, Kevin is typically relaxing, sipping on fine bourbon, and smoking barbecue in his backyard with his family.

Victoria Cabrera, Owner, The Insurance Space

Victoria Cabrera, a 20-year health insurance industry veteran, is the owner of The Insurance Space and founder of the Tech Savvy Insurance Agents community. Known for blending technology with traditional service, Victoria leads the charge in helping agents embrace AI and digital marketing to grow their businesses while staying up to date with compliance and regulations to ensure they operate the right way. As a leader in tech adoption, she is passionate about equipping brokers with the tools and strategies needed to succeed in the next wave of insurance innovation.

Qiyun Cai, CEO & Co-Founder, Fintary

Qiyun Cai is the Founder and CEO of Fintary, an AI-powered revenue growth platform transforming how insurance companies manage commissions and financial operations. A former founder of an insurance company and Harvard MBA graduate, Qiyun brings deep industry insight to modernize outdated processes and empower insurers to scale with confidence. Her mission is simple yet powerful: to help insurance businesses increase profits, reduce costs, and turn complex commission operations into a growth engine. Through Fintary, she’s helping agencies, brokers, and carriers unlock efficiency, accuracy, and profitability in days—not months.

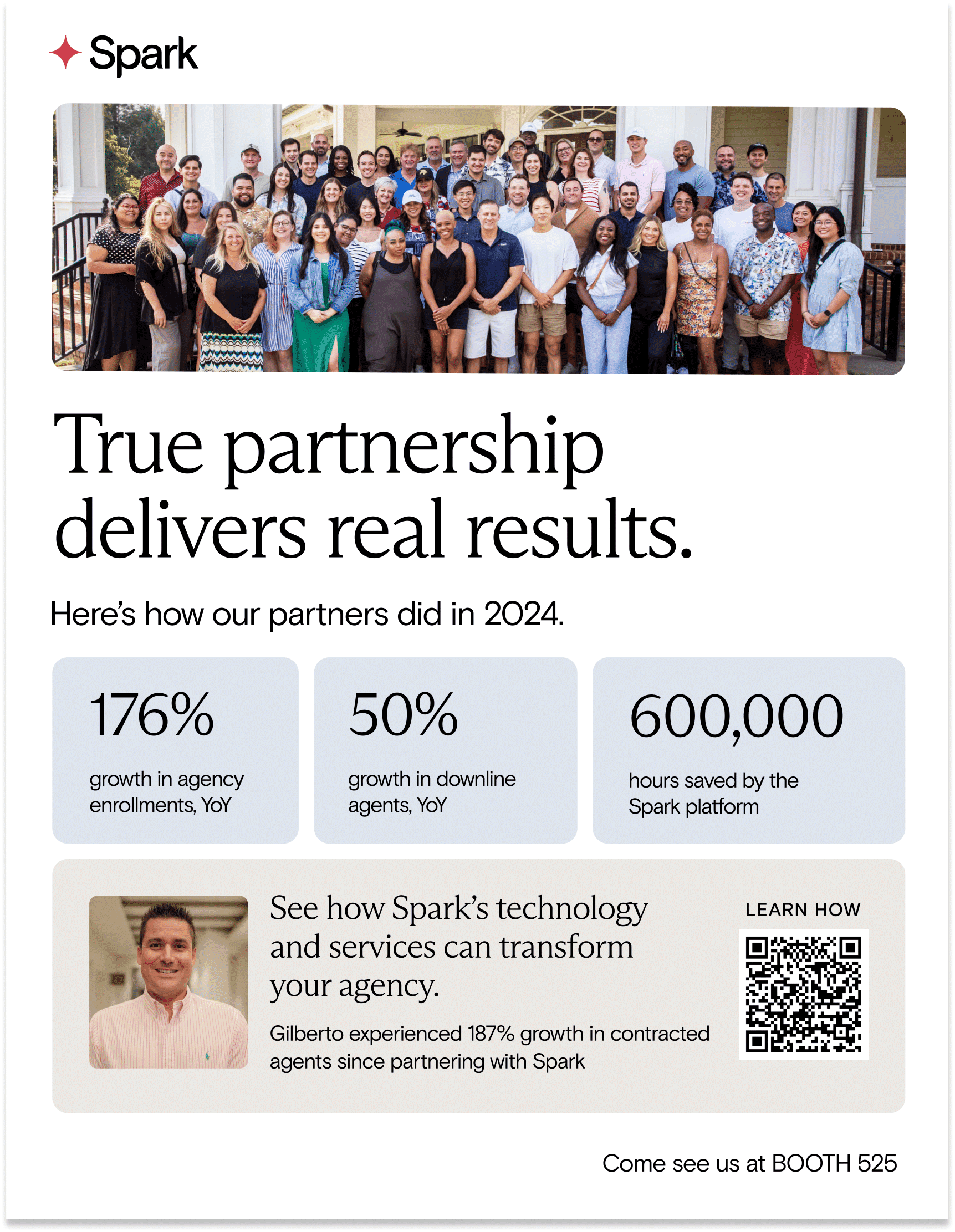

Caleb Campbell, Head of Sales, Spark Advisors

Caleb Campbell is a seasoned sales leader with over a decade of experience building and scaling high-performing revenue organizations. As Head of Sales at Spark, a leading Medicare insurance technology company, Caleb is driving the next generation of sales infrastructure to help health plans and FMOs grow more predictably and efficiently. His background spans SaaS, higher education, and real estate technology, with a consistent track record of building teams, entering new markets, and exceeding revenue targets. Caleb brings a builder's mindset to every stage of growth — from zero to scale — and is passionate about transforming how Medicare is sold.

Briana Cardoza, Chief Business Development Officer, briana.cardoza@truecare.org

Briana brings 15 years of dedicated experience in the nonprofit healthcare sector and currently oversees the strategic growth and development of multiple branches within TrueCare, a leading Federally Qualified Health Center (FQHC) serving diverse communities across the region. In her role, she drives initiatives that strengthen TrueCare’s capacity to meet community needs—including through innovative partnerships that expand access, improve care coordination, and advance health equity.

Throughout her tenure, Briana has been instrumental in building strategic alliances, securing sustainable funding, and launching programs that demonstrate the critical role FQHCs play in delivering high-quality, comprehensive care to Medicare & Medicaid populations. Her work is rooted in a deep understanding of community health and a belief that strong partnerships between partner organizations and FQHCs are essential to ensuring equitable, patient-centered care.

Briana leads cross-functional teams with an emphasis on collaboration, operational excellence, and measurable outcomes. She holds a Bachelor of Science from Cornell University and a Master’s in Public Health with a concentration in Community Health from UCLA, and she is a Certified Lean Six Sigma Green Belt.

Maria Carrizosa, Director of Growth, FL, The Baldwin Group

Maria Carrizosa is the Director of Growth for Florida and the East Region at The Baldwin Group, where she leads multi-market Medicare brokerage strategy focused on scalable growth, recruiting excellence, and profitability. With over 16 years of industry experience, she builds high-performing teams and growth frameworks that drive measurable results across complex markets.

Heidi Castaneda, AVP of Small Employer & Individual Products, Select Health

Heidi Castaneda is the Assistant Vice President of Small Employer and Individual Products at Select Health. With 29 years of experience, she leads a team serving nearly 500,000 members across Utah, Idaho, Nevada, and Colorado. Heidi focuses on customer service, relationship building, and simplifying healthcare. She believes, "By simplifying healthcare, we pave the way for a future where wellness is within everyone's reach." Passionate about service, Heidi is dedicated to making healthcare accessible and empowering for all. Outside of work, Heidi enjoys gardening, hiking, swimming, and planning Disney trips with her family.

Melinda Caughill, Co-Founder, HeyMoe

Melinda Caughill is a national leader in fee-for-service Medicare strategy and the Co-Founder of 65 Incorporated and the Medicare platforms i65 and HeyMOE. For nearly 15 years, she has built a sustainable Medicare advisory business without selling insurance—working directly with individuals, employers, and fee-only financial advisors who require truly unbiased guidance. Trusted by organizations including PBS and Macmillan Publishing to provide Medicare expertise, Melinda has also been featured in publications like The Wall Street Journal, Consumer Reports, Barron’s and more. As Part D commissions disappear, she is helping professionals rethink revenue—showing how Medicare strategy can become a paid service, not just a product conversation, while candidly addressing the realities of the fee-for-service path.

Johanna Cazares, CGO, Alcar Health

Johanna Cazares is Chief Growth Officer at Alcar Health, where she leads growth strategy and partnerships supporting Federally Qualified Health Centers nationwide. With more than 15 years of experience in healthcare operations and market development, she specializes in Medicare and Medicaid enrollment strategy, contact center optimization, and culturally aligned outreach. Johanna oversees bilingual engagement programs, licensed agent partnerships, and data-driven workflows that improve patient access, retention, and financial sustainability. Known for her human-centered, execution-focused approach, she helps health centers translate complex operational and policy challenges into practical solutions that strengthen care delivery, staff engagement, and community trust.

Jordyne Cerullo, Director, Agency Sales, HealthSherpa

Jordyne Cerullo is a sales leader in the ACA health insurance space, focusing on agency growth, success and retention. She's spent the last five years committed to advancing technology focused on greater access to affordable quality coverage.

Marie-Laure Chandumont, Managing Director, Barclays

Marie-Laure runs Barclays Insurance team, the #1 hedging counterparty to all annuities as per statutory filings. She started her career in 1998, in Investment Banking and moved on to the Trading Floor in 2004. Her expertise revolves around derivatives, hedging, insurance accounting, regulation and the overall retirement ecosystem. She graduated from EDHEC Business School with a dual Major in Corporate Finance and Global Markets and is a Certified Financial PlannerTM

Louis Cipriano, Market Leader, Publishers & Lead Generation, ActiveProspect

As VP Alliances - Publishers & Lead Generation, Louis oversees strategy & applications across Publishers & Data Companies. As an early member of Jornaya, and now with the business for 12-years, Louis has spent his career creating long-lasting bi-directional partnerships and enabling Fortune 500 companies & startups across Insurance, Consumer Finance, Education, Home Services, and Media & AdTech to build more profitable & compliant marketing programs.

Tyrone Clark, CEO & Founder, Brokers Choice Of America

Tyrone Clark is the President and Founder of Brokers’ Choice of America. A seasoned veteran for over 43 years in the insurance business, Tyrone’s massive achievements are startling to say the least. Tyrone began his career at age 17 and eventually became an annuity legend. Tyrone has produced millions in annuities as a producer and conducted television shows, radio shows, and infomercials. He has conducted over 2,000 seminars in 49 states in front of 50,000 retirees and designed over 50 different seminars. Tyrone is responsible for over $15 billion in annuity sales. He has trained over 8,000 agents and continues to do so. The biggest annuity producers have been through Tyrone’s annuity training.

Brandon Clay, Chief Brand Officer, EnrollHere

Brandon Clay is Chief Brand & Industry Officer at EnrollHere, shaping the future of Medicare distribution by connecting carriers, agencies, and brokers through AI-powered infrastructure that drives visibility, compliance, and performance. With more than 30 years in the Medicare industry, Brandon’s experience spans carrier strategy, field distribution, agency growth, and technology innovation. He began his career as an agent and rose to executive leadership roles scaling nationally through multiple growth cycles and acquisitions. He is an author, speaker and recognized thought leader focused on helping agents and agencies succeed and grow in an evolving, technology-driven marketplace.

Jim Codney, Chief Sales Officer, The Annuity Link

Jim Codney began his insurance career in 1999 in a property and casualty call center, where he developed a strong foundation in client service and risk management. After seven years, he transitioned into the health and retirement planning insurance sector, building a diverse résumé as an individual producer, agency owner, and carrier representative. Today, Jim serves as Chief Sales Officer at The Benefit Link in Colleyville, Texas. In this role, he leads sales strategy, organizational growth, and agent development across the company’s core product lines, including annuities, life insurance, Medicare supplement, and ancillary benefits. Known for his commitment to integrity, clarity, and client-first service, Jim continues to guide The Benefit Link toward sustainable expansion while empowering agents to deliver expert, compassionate solutions to the individuals and families they serve.

Jen Cohen-Smith, SVP, Medicare, Healthfirst

Jen Cohen-Smith is a distinguished leader in the health insurance industry, known for building and scaling high-performing Medicare plans. As Senior Vice President of Healthfirst’s Medicare division, she leads strategy, performance, and growth for the organization’s Medicare Advantage portfolio. Since joining in 2021, she has strengthened Healthfirst’s position as the #1 Medicare Advantage plan in the New York Metro area. Today, the plan serves more than 325,000 members across 10 counties, generates over $7 billion in revenue, and has earned consecutive 4.5-star ratings. Previously, Jen held senior leadership roles at Beacon Health Options, UnitedHealth Group, Optum Care, Aetna, and Anthem/WellPoint.

Matthew Cornish, Managing Director, Solomon Partners

Matthew Cornish is a Managing Director in the Financial Institutions Group at Solomon Partners, a leading investment bank. He focuses on Insurance Services, Illiquid Financial Assets, and related sectors. Matt has over 15 years of experience in financial services, having successfully executed a wide variety of transactions across multiple industries and asset classes, including benefits, TPAs, P&C claims, Medicare, ACA, self-funded healthcare, life settlements, tax receivable agreements, capital raising, minority equity, secondaries, and private equity and hedge fund LP interests. Prior to joining Solomon, Matt was a Director in the Financial Services Group & Illiquid Financial Assets Group at Houlihan Lokey. Earlier, he worked at Ernst & Young in the Valuation & Business Modeling practice.

Cynthia Cox, Vice President, Kaiser Family Foundation

Cynthia Cox is a vice president and Director of the Program on the ACA, where she conducts economic and policy research on the Affordable Care Act and its effects on private insurers and enrollees. Her work focuses on enrollment, pricing and competition in the ACA’s exchange markets. Cox also directs the Peterson-KFF Health System Tracker, a partnership of the Peterson Center on Healthcare and KFF aimed at monitoring the performance of the U.S. health system over time and in relation to other large, high-income countries. Her work on this project focuses on trends in health care costs, access and affordability, as well as measures of health care quality and outcomes. Prior to joining KFF, she held research and advocacy positions at Columbia University Medical Center and the American Cancer Society. She also served on the board of directors of the Berkeley Free Clinic in California. Cox holds a bachelor’s degree from the University of California, Berkeley, and a Master of Public Health degree from Columbia University.

John Crumbliss, Principal, Cornerstone Government Affairs

John Crumbliss joined Cornerstone Government Affairs in 2004. Since then, John has represented a broad portfolio of clients that include technology companies, institutions of higher education and health care. Leading these clients on a diverse range of issues, he has devised and implemented strategies that have resulted in concrete policy changes and subsequent federal support for the organizations represented. On behalf of Cornerstone and its clients, John has worked extensively with both chambers of Congress, the Department of Health and Human Services, the Department of Labor, the Department of Education, the Department of Energy, the White House and a number of Democratic governors.

Jay Csipkes, VP of Sales and Marketing, American-Amicable Group

Jay is a revenue-focused distribution executive who has successfully scaled multiple insurance companies’ sales results over his 23 year career. Skilled in growing life, health and Medicare distribution, Jay is dedicated to achieving profitable growth and fostering strong team collaboration to meet aggressive growth objectives. In his current role as Vice President of Sales at American-Amicable Life Insurance Company, he has helped orchestrate a 94% increase in sales over the last 4 years through distribution expansion and leveraging the company’s value proposition to agents.

Aaron Davis, Head of Hosted Solutions, ConnectureDRX

Aaron Davis is a technology leader with extensive experience in patient centric healthcare technology. He is the Product Director for ConnectureDRX's Plan Compare ONE, a Medicare shopping, quoting, enrollment, and retention platform. Aaron comes from a background in consumer research and product experimentation, running rapid research projects for Fortune 500s such as AARP, Cigna, Experian, and Intuit. Previously, he has served in an innovation role to build a patient engagement platform for individuals with rare diseases. He has a BA in finance and was a University Innovation Fellow at Stanford University's school.

Madeline Deagle, President, Connexion Point

Madeline Deagle currently serves as President of Connexion Point, a BPO in the Healthcare space. With over a decade of experience in performance marketing and insurance technology, she specializes in optimizing telephonic experiences and transforming complex operations into scalable, profitable engines. Madeline is driven by a passion for turning insight into innovation and operational excellence into measurable impact. She's known for building high-performing teams and driving strategic initiatives that align technology, process, and people.

William DeCourcy, Chief Lead Generation Officer, AmeriLife

William R. DeCourcy, Jr. MBA (Bill) has been with AmeriLife since November 2021. Upon starting at AmeriLife, Bill built the lead distribution mechanisms for AmeriLife’s Direct-to-Consumer Call Center and lead the MarTech overhaul of their supporting infrastructure. Bill also founded and built an enterprise-wide leads distribution system (LeadStar), which provides real-time exclusive data leads, inbound and warm-transfer phone calls, direct mail, in-person appointments, and seminar services for AmeriLife’s contracted agents and call centers. Bill has a deep background in technology, research, and lead generation across several industries. Bill resides in Orlando with his wife and, in his free time, enjoys woodworking, fishing, and volunteering in his community as the coach of a high school robotics team.

Bob Dehncke, Owner, Dehncke Insurance Services

Bob has worked in the insurance industry for almost 30 years. He is an author and is part of Marquis Who’s Who in America. He started out helping people prearrange and prepay for their funerals, working with and for both independent funeral homes and the insurance companies. Bob then moved into Medicare sales starting in 2003. He worked for several big insurance companies as either sales manager or director of sales. Bob got tired of corporate life and decided to go independent in 2009. Bob says the biggest reason for his success has been his willingness to become an industry expert at every stop. What is something Bob would like everyone in the industry to know? Learn how to ask for referral, and most importantly, “Be Referable!"

Ricardo Diaz, Medicare Director, Futuro Insurance

As the Medicare Director at Futuro Insurance, I bring over 16 years of experience as a licensed insurance agent specializing in Medicare solutions. Throughout my career, I have focused on serving the Hispanic community and low-income families, helping clients navigate the complexities of Medicare with clarity, trust, and personalized guidance. Born and raised in the El Paso–Juárez border region, I understand the unique cultural and financial needs of our community. My background allows me to connect with clients on a personal level while providing knowledgeable, ethical, and compassionate service. I hold an MBA in Finance, which strengthens my ability to guide individuals in making informed healthcare and financial decisions that protect their long-term well-being.

Ryan Dietz, Manager, Competitive Intelligence, F&G

Ryan Dietz is the Manager of Competitive Intelligence at F&G. He has been in the industry for 15 years with varying roles between Sales, Marketing, Operations and Product. His current focus is supporting Annuity product and distribution strategy with a passion around product portfolio management and innovation in the retirement space.

George Dippel, President, Deft Research

George Dippel spent the first 12 years of his career with Procter & Gamble at P & G’s renowned Healthcare Consumer Institute. While there, George studied the healthcare consumer across all aspects of care delivery and used those insights to provide high-level consultation to both P & G’s internal brand teams as well as many partner health insurance carriers. George brought his healthcare consumer market research expertise to Deft in 2010, and since then has worked with more than 130 carriers to help them better understand the modern healthcare consumer. George’s range of healthcare consumer research expertise spans Medicare Advantage, MedSupp, Small Group, ACA, Uninsured, PBM and Part D.

Neka Doe-White, CEO, The Possibilities Group

I’m Neka Doe White. I am an Augusta, Georgia native, Army Veteran, wife, mother, and founder of The Possibilities Group. My mission is simple: to make Medicare real, relatable, and easy to understand. My journey from being uninsurable to helping others find confidence in their coverage is proof that faith, resilience, and compassion can change everything. I bring humor, heart, and honesty to every stage because education should feel human. Through my nonprofit, Possibilities Unlimited, I help inspire and equip others with the life skills to rise, rebuild, and believe in what’s possible.

Romelyn Dones, Senior Director of Medicare, MLTC and MAP Sales, MetroPlus Health

Romelyn Dones brings over 20 years of experience in the healthcare and insurance sectors, distinguished by her exceptional leadership and strategic expertise. As Director of Medicare Sales at MetroPlusHealth, she drove a 20% increase in sales, expanding access to essential healthcare services. She also served on MetroPlusHealth’s Medicare Town Hall panel, where she provided valuable guidance to the community—helping seniors better understand Medicare and navigate their benefits. Romelyn is recognized for her strengths in strategic sales planning, market expansion, and customer relationship building while fostering high-performing teams. Before joining MetroPlusHealth, she advanced community education and engagement at Anthem Blue Cross and Blue Shield, implementing strategies to raise awareness of healthcare options. At HealthFirst, her leadership significantly increased Medicaid enrollment, ensuring more low-income individuals and families gained coverage. She holds a Bachelor of Science from St. John’s University, a Master of Public Administration from Rutgers University, and is currently pursuing a Ph.D. in Health Sciences at Seton Hall University. She resides in New Jersey and is a proud mother of three.

Alex Doonanco, CEO & Co-Founder, careCycle

Alex Doonanco is co-founder and CEO of careCycle, the AI-native retention operating system for Medicare and ACA agencies. As agencies lose 20-40% of members annually while agents waste hours on non-revenue work, Alex built careCycle to turn retention from cost center into revenue driver. His platform has automated over 4 million member conversations, helping agencies keep 10%+ more members while freeing agents to focus on production. With expertise in Medicare compliance and AI, careCycle delivers a unified phone system, CRM, and voice AI workspace where human and AI agents collaborate seamlessly—backed by Y Combinator and trusted by leading distributors.

Paul Dornier, CEO & Co-Founder, Alpharun

Paul Dornier is the CEO and co-founder of Alpharun, an AI sales coaching platform that helps Medicare brokerages make every agent their best agent. Alpharun analyzes 100% of calls to identify what top performers do differently and deliver personalized coaching that lifts every agent's enrollment rates. Previously, Paul co-founded Meetingbird, a Y Combinator-backed scheduling platform acquired by Front, where he spent four years leading the product team. Paul holds a B.S.E. in Computer Science from Princeton University and is based in San Francisco.

Henry Dornier, President & Co-Founder, Alpharun

Henry Dornier is the President and co-founder of Alpharun, an AI sales coaching platform that helps Medicare brokerages make every agent their best agent. Alpharun analyzes 100% of calls to identify what top performers do differently and deliver personalized coaching that lifts every agent's enrollment rates. Before Alpharun, Henry co-founded Meetingbird, a Y Combinator-backed scheduling platform acquired by Front, where he went on to serve as General Manager. Henry studied Computer Science at Harvard and is based in San Francisco.

Terry Dry, Co-Founder & CEO, The Smarter Service

Terry Dry is an entrepreneur, marketer, and advisor with over 25 years of experience building and transforming companies. He is the co-founder and CEO of The Smarter Service, a technology concierge provider supporting older adults and senior living communities with personalized tech support. Terry is also the founder of Future Proof Advisors, where he works with mid-market businesses to overcome growth barriers. His track record includes successful exits of RSVD, a SaaS company acquired by CLEAR, and Fanscape, an early social media agency acquired by Omnicom. Terry has spoken at CES, the What’s Next Longevity Innovation Summit, Mirren Live, and WOMMA.

Jessica Dunn, National Director, Care Planning Connect

Jessica Dunn is the National Director of Care Planning Connect, where she leads the development of referral partnerships that bridge Medicare planning and holistic financial planning. She works closely with Medicare agents across the country to help them extend the value of their client conversations beyond enrollment, into estate, income, and long-term care planning. With a practical, agent-first approach, Jessica focuses on simple handoffs, compliant workflows, and trust-based collaboration that benefits both advisors and families. She brings a field-tested perspective on how Medicare professionals can deepen client relationships, unlock new revenue opportunities, and confidently transition Medicare conversations into comprehensive financial planning engagements.

Tyler End, CEO & Co-Founder, Retirable

Tyler End is CEO and Co-Founder of Retirable, a holistic retirement planning platform helping everyday Americans achieve financial confidence. With nearly 15 years of experience in financial services, Tyler founded Retirable to make personalized retirement advice accessible to everyone. Before launching Retirable, Tyler served as a leading financial services firm, where he helped clients define their goals, achieve financial independence, and retire with peace of mind. He later joined Policygenius, where he expanded the company into new product lines as Head of Operations Expansion. Tyler and Retirable have recently been featured on Good Morning America and quoted in The Wall Street Journal, Kiplinger's, FOX Business, MONEY, Forbes, and other leading publications. Tyler is passionate about bringing financial literacy and retirement planning to Americans who need it most.

Ryan Fajkowski, Brand Awareness and Strategic Partnerships, INSXCloud Inc.

Ryan Fajkowski is a seasoned expert in the individual health insurance industry with over 17 years of experience. He has led and worked extensively with major carriers and innovative platforms on direct-to-consumer initiatives, sales distribution, and lead generation, while building deep knowledge of ACA marketplaces, direct enrollment technologies, quoting, enrollment processes, and consumer-driven coverage solutions for individual medical and small group insurance.

Passionate about simplifying complex insurance landscapes, Ryan focuses on greater transparency, stability, and accessibility in health and group insurance products. He helps drive growth, business development, and strategic partnerships—growing INSXCloud an innovative platform—while supporting agents, agencies, carriers, consumers, and strategic partnership groups in navigating options effectively for more reliable and user-friendly experiences in the evolving ACA and broader insurance sectors.

Manny Felix, Senior Manager, Medicaid Sales, Blue Cross Blue Shield of Arizona

Manny is an award-winning Medicare sales leader with a passion for health equity and professional development. In his current role, Manny partners with brokers, agency principals, and FMO leaders to drive growth through smart, actionable sales strategies. His training sessions are more than informative, they’re empowering. Manny breaks down the complexities of Medicare Dual Special Needs Plans (DSNP) and Medicaid with clarity and relevance, equipping partners with the tools they need to thrive in today’s competitive market.

Helaine Fingold, Partner, Epstein Becker & Green, P.C.

Helaine I. Fingold is a Partner in the Health Care and Life Sciences practice in the Baltimore office of Epstein Becker Green. She has more than 34 years of broad health law and health regulatory experience, including 20 years in the federal legislative/executive branches. Ms. Fingold advises health care plans and issuers, providers, and other stakeholders on legal and policy issues regarding the Medicare Advantage and Part D programs, including, but not limited to: general program compliance and corrective action; marketing, agent/broker and other TPMO issues; star ratings/quality bonus payments; plan application process, standards and appeals; program/financial audits and other program oversight; and program enforcement/sanctions and appeals. She also advises on Medicare Parts A and B; Medicaid fee-for-service and waiver/managed care programs; Medicare and Medicaid innovation programs; PACE, Qualified Health Plan and commercial plan requirements under the ACA; and federal and state Surprise Billing rules. From 2004 to 2012, Ms. Fingold worked in a range of capacities at the Centers for Medicare & Medicaid Services (CMS), with responsibility for areas of the Medicare Advantage program, including plan application review and approval, network adequacy, plan application denials and appeals, contracting, plan surveillance and oversight, and Medicare Advantage and Part D marketing. Subsequently, Ms. Fingold served in both senior staff and leadership roles with the Center for Consumer Information and Insurance Oversight (CCIIO) in the Exchange Policy and Operations Group through which Ms. Fingold worked on the qualification of qualified health and stand-alone dental plans, plan oversight, essential health benefits, agent/broker issues, and market-wide cost sharing limitations.

Troy Fisher, CEO, SeniorCenterAgents.com

As founder of SeniorCenterAgents.com, he created an AI-powered lead platform connecting publishers with independent agents through real-time lead intelligence and embedded AI assistance. Now launching AI voice agents modeled on his proven sales flow, Troy's platform qualifies leads before a human ever picks up—replacing traditional fronters, cutting costs, and positioning agents at the front edge of where the industry is heading. Troy Fisher is a top-producing, multi-state licensed insurance agent who mastered phone-based senior market sales—then built the technology to scale it.

Aaron Flores, Chief Deputy, HRA Council

R. Aaron Flores is Chief Deputy at the HRA Council, leading the annual "Growth Trends for ICHRA & QSEHRA" report and managing member experience and operations. His background includes creative services, business development, organizational leadership, and policy. Prior to HRA Council, he led the nonprofit creation of the largest rooftop farm in Texas as Chief Operating Officer and Lead Skyfarmer, for which he was featured on Good Morning America, and has delivered a TEDx talk on community building available at ted.com. Outside of his work, Aaron is a passionate community educator in ancestral wellness, regenerative agriculture, and localism.

Zachary Freeman, Insurance Agent, Ann M Wiley Insurance

Zachary Freeman is a seasoned Medicare and life-insurance specialist serving Ashtabula County, Ohio. Since entering the field in 2015, he has earned multiple top-agent honors, including JSA Top Agent (2019–2021), UHC Premier Platinum Producer, TLC Top Agent (Cabo), and NABIP Leading Producer Round Table – Soaring Eagle, along with volunteer awards from ACES (2016, 2018). He is an active member of the NABIP Medicare Advisory Group and the Prescription Drug Working Group. Through Wiley Insurance Services, Zachary helps clients navigate Medicare Advantage, Medicare Supplement, Prescription Drug Plans, and ancillary benefits with a strong focus on education, ethics, and long-term support.

Ned Gaines, Insurance Commissioner, State of Nevada

Ned Gaines was appointed Nevada’s Insurance Commissioner on October 6, 2025, after serving in an acting capacity since July. He oversees consumer protection and public interests in insurance matters. Gaines brings over 25 years of experience, joining the Nevada Division of Insurance in April 2025 as Chief Deputy Commissioner. Previously, he spent 12 years with Washington’s Office of Insurance Commissioner, most recently as Deputy Commissioner of Rates, Forms, and Provider Networks. He holds multiple professional designations, is active in IRES and AICP, and was elected Secretary/Treasurer of the NAIC Western Zone for 2026. Gaines earned a master’s in public policy and a bachelor’s in business

Paul Garofoli, Regional VP, The Standard

Paul Garofoli, FLMI, RICP®, is an Annuity Regional Vice President for the Standard with a 44-year career touching upon all aspects of our industry, especially independent distribution. Nicknamed the “King of Annuities,” his enthusiasm is legendary. A nationally recognized speaker, Paul is known for his entertaining presentations. Paul also serves on the Board of Directors for the National Association for Fixed Annuities (NAFA) where he continues to advocate for the industry.

Sandra Gebhardt, Online Marketing Strategist, Sandra Gebhardt Marketing

As a digital marketer with years of experience, Sandra has worked with thousands of small business owners, trained in high ticket consulting groups, spoken at multiple events including TEDX, been featured in two documentaries, runs a top rated Podcast (Binding Authority) all while being a wife and keeping the worlds cutest four year old entertained, happy and from falling off of tall things he climbs. Sandra is extremely passionate about helping people solve problems they are having in business. She has been described as being “a bit too much” or “a busy body” and voted “most eager to please” by her Highschool Senior Class. Sandra took these labels and turned into being famous for being a power connector and helping small business owners fix advertising and marketing issues. Known as the “Queen Of Organic Social Media Marketing.” Sandra is passionate about teaching agents to build their own personal brand. She also runs a group consulting course where she focuses on coaching and helping agents build smart marketing plans!

Michael Gende, Regional Sales Manager, GTL

Michael has been in Sales Management and Motivation all his life and the insurance industry for 18 years. He is known for his unrelenting positive attitude/outlook on life, as he has never seen a situation that did not have some ray of sunshine peeking through. ‘Everything you want is sitting on the other side of fear’ is his favorite quote!

Samantha George, CEO & Founder, Mystic Consulting

Samantha is the CEO & Founder of Mystic Consulting. She has over 22 years of experience in the Healthcare Industry. Her varied knowledge spans from provider offices, Medicare agent, carrier leadership, FMO leadership to consulting firm and agency founder. Samantha currently serves on NABIP’s Medicare Advisory Group and Individual Working Group. She believes that agent education is the key to empowerment in agents being strong advocates for themselves and their clients.

Joanne Giardini-Russell, Vice President, Giardini Medicare

Joanne Giardini-Russell is VP of Giardini Medicare, a Medicare-specialized insurance agency serving clients across 24 states. With over a decade of industry leadership, she has built a reputation for education-first Medicare guidance that prioritizes transparency over sales pressure. As a Medicare educator and content creator with nearly 100,000 TikTok followers, Joanne helps people navigate the transition to Medicare with clarity and confidence. Her philosophy is simple: ask the right questions first, reduce anxiety, and empower beneficiaries to make informed decisions about their coverage—without the high-pressure sales tactics common in the industry.

Marc Glickman, CEO & Founder, BuddyIns

Marc Glickman, FSA, CLTC is CEO and founder of BuddyIns, which is an open community of LTC insurance experts. BuddyIns operates as an FMO in all 50 states specializing as the group LTC division for large agencies and brokers. BuddyIns provide agent training, quoting tools, and a turnkey group enrollment platform. Marc is an actuary by profession and graduated from Yale University with a degree in economics.

Aaron Goddard, President, Allstate Health Solutions

As President of Allstate Solutions, this individual leads a dynamic team dedicated to delivering exceptional health insurance solutions. With over 20 years of industry expertise, they focus on fostering innovation, empowering teams, and driving significant organizational growth. Under their leadership, the company has surpassed $1 billion in revenue, a milestone achieved through collaboration and strategic market expansion. Their mission centers on creating cutting-edge insurance products and advancing distribution channels to meet evolving market needs. By leveraging an extensive background in health and life insurance, they continue to champion initiatives that blend technology and customer-centric strategies, ensuring sustained growth and a bright future for the organization.

Brian Goetsch, Senior Partner, Healthscape Advisors

Brian Goetsch is a Senior Partner at HealthScape Advisors, a Chartis Company, where he offers strategic, financial, and operational guidance to health plans, specialty health organizations, and private equity investors. As a co-leader of HealthScape’s Ancillary Center of Excellence, Brian focuses on the Dental and Vision sectors, including managed care, providers, labs, and emerging technologies. Brian has led initiatives on product expansion, market entry, network and cost management, partnership strategies, and inorganic growth. Before HealthScape, he was a senior executive at EyeMed Vision Care, driving the "One-Stop-Shop" strategy and other significant projects. Brian began his career at Huron Consulting Group and holds a Master's and Bachelor's in Accountancy from the University of Illinois.

Tom Goila, Partner, Head of Originations, & Co-Head of Healthcare, Comvest Credit Partners

Tom joined Comvest Partners in 2017. He is a Partner of the Firm and Head of Originations and Co-Head of Healthcare for Comvest Credit Partners. He serves as a member of Comvest’s Executive Committee and the investment committees for Comvest Credit Partners and Comvest Credit Opportunities, Comvest’s opportunistic credit strategy. In addition, Tom is responsible for originating, structuring and managing investments in healthcare as well as in other industries of focus for both strategies. Prior to joining Comvest, Tom was a Senior Restructuring and Finance Consultant for a healthcare-focused specialty finance firm. He also worked at Goldman Sachs, first as a Vice President and then as a Director in the Specialty Lending Group within the Special Situations Group, where he focused on mid-market and healthcare investing. Tom also has held healthcare finance roles at BNP Paribas and First Union. Tom received a B.A. in Accounting from Furman University.

Carroll Golden, Executive Director of Knowledge Centers, NAIFA

Carroll Golden serves as Executive Director of the NAIFA Knowledge Centers, where she leads the Lifetime Healthcare Center—the home of the Medicare Collective. With decades of field and executive experience in insurance and advisor distribution, Carroll helps Medicare-focused FMOs, carriers, and professionals stay ahead of the issues that shape client outcomes, from policy and regulation to market shifts and consumer needs. She is a respected advocate for long-term, multigenerational financial security and a trusted voice across the industry. Carroll has authored four books, contributes to leading trade publications, and speaks frequently for companies and professional groups.

Harley Gordon, President, Insurance Education Advisors

Harley Gordon, Esq. is a founding member of the National Academy of Elder Law Attorneys. His views have been featured in The Wall Street Journal, The CBS Nightly News, and the PBS Frontline documentary, “Who Pays for Mom and Dad?” Senior Market Advisor selected him among the “10 Most Influential People” in the LTC industry.

Paul Gregory, Co-Founder, Powervox

Paul Gregory is a co-founder of Powervox and a serial entrepreneur. He previously founded System Target, Esport Supply, and Zodiac Labs. Paul held senior leadership roles at SelectQuote (NYSE: SLQT), including Executive Vice President of the Life Insurance Division and Executive Officer, as well as Senior Vice President of IT, Data Science, and Recruiting, and Vice President of Sales and Operations for the Senior division. Earlier, he served as Chief Revenue Officer of Corvisa from 2012–2016, prior to its sale to ShoreTel (NASDAQ: SHOR). Paul began his career at Merrill Lynch, where he focused on finance, strategy, and leadership development.

Jessica Grover, CEO, RiskLync

Jessica Grover is Co-Founder & CEO of RiskLync, a performance-first lead intelligence platform revolutionizing Medicare insurance acquisition. RiskLync applies behavioral underwriting to predict lead conversion, solving the $50B Medicare acquisition crisis where leads are wasted and conversion rates remain low. Before founding RiskLync, Jessica spent 25+ years driving marketing transformation for Fortune 500 companies including Allstate, Nissan, and Danaher, consistently delivering exceptional ROI through data-driven strategies. She holds a B.A. in Communications from USC and is a Danaher Business Systems Master Black Belt. Jessica is based in Nashville, TN.

Carey Gruenbaum, CEO & Founder, The Big Plan

Carey Gruenbaum is the Founder and CEO of The Big Plan, a leading ICHRA platform helping brokers and employers transition from traditional group health plans to individualized, cost-controlled benefit strategies. With more than 30 years in the employee benefits industry, Carey built and scaled both a benefits and property & casualty brokerage business, which were successfully acquired by HUB International in 2024. He also currently serves as Senior Vice President at HUB International, where he continues to drive innovative benefit solutions and national broker partnerships. Carey is widely recognized for translating complex healthcare funding strategies into practical growth opportunities for advisors and employers alike.

Chase Gruening, CEO & Founder, Gruening Health & Wealth

Chase Gruening is a championship college football coach turned Medicare industry leader, bringing a rare blend of disciplined coaching, operational strategy, and real-world production experience to the agents and agencies he supports. After transitioning from athletics into insurance, Chase built Gruening Health & Wealth into a multi–seven-figure Medicare and retirement agency before founding COACHG, one of the fastest-growing collaborative development platforms in the industry. Today, Chase trains agents nationwide on increasing revenue per client, building strong operational systems, and developing high-performing teams. His mission is simple: to develop championship producers and build championship teams through structure, accountability, and proven systems.

Melissa Gwennap, Director, MedSupps, Humana

Melissa Gwennap is an accomplished insurance professional with 26 years of industry experience.She is a Director - Medicare Supplement with Humana. As a licensed agent, she has expertise across claims, customer service, agent service, sales, and all ancillary and long-term care products, specializing in training agents & FMO's on Medicare. Outside of work, Melissa enjoys traveling with her husband of 24 years, spending time with their three daughters and three grandchildren, boating, bowling, and exploring tropical destinations. She is an avid football fan.

Darwin Hale, CEO & Founder, Advocate Health Advisors

Dr. Darwin Hale is the Founder and CEO of Advocate Health Advisors, one of the nation’s leading FMOs in the Medicare Advantage market. With over 30 years of leadership experience across healthcare, technology, and corporate strategy, Dr. Hale has helped shape the Broker distribution model for modern Medicare. Prior to founding Advocate in 2005, he held senior roles at AT&T and IBM, leading national healthcare initiatives. He’s also a decorated U.S. Army Colonel (Ret.) and earned his Doctorate in Business Administration with a focus on Broker quality. Dr. Hale speaks nationally on Medicare and is the bestselling author of Need to Know, a guide to navigating the U.S. healthcare system.

Melissa Hall, CEO, The Hall Insurance Group

Melissa D. Hall is a prominent thought leader in the Medicare sector and the voice of female agents. She began her insurance career in college and has since guided thousands through her successful YouTube channel and innovative courses, including the Medicare Masters Academy, which trains agents in Medicare sales within 10 days. Passionate about building community engagement and media presence, Melissa empowers agents to connect with the senior community. She is also the owner of Hall Insurance Group, where her motto is “Everyone Matters.”

Mike Hardle, Chief Revenue Officer, Agent Boost Marketing

Mike Hardle is the CRO and part owner of Agent Boost Marketing. Agent Boost is one of the largest independently operated FMOs in the Medicare and ACA space. Mike and his brother Dan (Agent Boost CEO), co-host the Agent Boost Podcast. A weekly podcast that functions as a behind the scenes tell all and talks in depth about industry trends and topics. Mike is an entrepreneur, adventurer, and fitness enthusiast. When Mike is not Running with the Bulls, swimming with sharks, or pushing himself physically, he is spending time coaching football or relaxing with his family!

Benjamin Harrison, CRO, NCD

Ben Harrison is Chief Revenue Officer at NCD, where he leads national sales, distribution strategy, and growth across the Medicare and under-65 markets. With more than 15 years of experience in health insurance, he specializes in transforming ancillary products into meaningful revenue engines for agencies and national distributors. Ben focuses on building durable growth through product attachment, retention strategy, and disciplined execution. He’s known for translating market insight into practical systems that help agents increase policies per household and long-term client value.

Leigha Hayes, Regional Sales Director, The Brokerage Inc.

Leigha Hayes is a Regional Sales Director in the Dallas-Fort Worth market with The Brokerage, Inc. She has 10 years of experience in the Medicare Industry. She supports agency partners and carriers through training, strategy, and relationship development. Leigha is passionate about helping others succeed and loves the work she does.

Jesse Hendon, Head of Ancillary & Life Products, Spark Advisors

With nearly 20 years of experience, Jesse Hendon is a seasoned insurance leader who has mastered the industry from every angle. His career spans the full lifecycle of ACA, MA, Med Supp, and Ancillary products. From sitting at kitchen tables and driving telephonic sales to leading national distribution at the carrier and FMO levels, Jesse brings a rare, 360-degree perspective to the market. Currently, he leverages this deep frontline and executive expertise to drive growth and innovation across national insurance landscapes.

Gaylan Hendricks, CEO, Senior Security Benefits

Gaylan Hendricks is a trailblazing entrepreneur and CEO, known for her exceptional leadership and charisma. As the founder and CEO of Senior Security Benefits, she has forged a remarkable path in the health insurance industry. Since its inception in 2000, Gaylan has guided her company to unparalleled success, achieving sales of over $120 million in 2020. In a male-dominated industry, Gaylan's determination and pioneering spirit have set her apart. She has fearlessly risen to the top, breaking barriers and inspiring others along the way. With a philosophy focused on helping others rather than competing against them, Gaylan has become a beacon of empowerment and knowledge sharing. Beyond her role as CEO, Gaylan is a sought-after speaker at prestigious events, captivating audiences at 8% Nation, LeadsCon, Medicare Gurus Mastermind, and Ms. Medicare. Through her platform, Queen of the Bundle, she coaches and guides industry professionals, providing personalized support through private training sessions, training videos, and a vibrant social media presence. Gaylan has built a thriving community of followers, all eager to benefit from her wisdom and experience.

Brent Hess, CRO, ConnectureDRX

Brent Hess is Chief Revenue Officer at ConnectureDRX, leading growth across sales, marketing, and strategic partnerships in the Medicare and ancillary markets. With more than 20 years of healthcare leadership experience, he brings a unique, end-to-end perspective shaped by starting his career as a broker, launching Humana’s Nevada market, building a Medicare Advantage plan for SelectHealth within Intermountain Health, and most recently leading product and sales for government programs at Cambia Health Solutions. As a patient advocate and people-first leader, Brent is focused on improving the beneficiary experience by turning complex data into actionable insights and empowering partners to drive better outcomes.

Michael Hilf, CEO & Co-Founder, Healthcare Funding Partners

Michael Hilf is CEO of Healthcare Funding Partners, LLC (HFP), an insurance-focused investment firm that has deployed over $1 billion in funding across the insurance markets. With 20+ years in healthcare, insurance, and finance, Michael brings expertise in M&A, private equity, and capital strategy, helping companies navigate growth, partnerships, and transactions. His leadership has fueled the expansion of HFP and its partners through thoughtful investments and long-term relationships. A passionate advocate for market innovation, leadership development, and mentorship, Michael combines strategic insight with a commitment to impactful business growth and community engagement.

Ben Hochstetler, SVP, Marketing, Quote.com

Ben Hochstetler is the Senior Vice President of Marketing at Quote.com, where he leads digital marketing strategy and execution across the company’s omnichannel performance marketing platform. He brings more than 15 years of experience building and scaling performance-driven marketing organizations in highly competitive and regulated markets, with a data-driven approach to decision making and execution. Prior to joining Quote.com, Ben led performance and corporate marketing teams at Healthcare.com, a leading consumer marketplace in the health and Medicare verticals.

Michael Howard, CEO, HIC Agency Inc

Howard Insurance LLC is an IMO agency solely focused in the life and health insurance space. Founded in 2013, we have been one of the largest insurance agencies in south Florida specializing in u65 life & health distribution. Whatever the case may be, a one stop shop who is prepared to anticipate and solve every need an agent has is invaluable. Having a diverse option of carriers which your agents or agency can provide to clients is one of the most important tools that leads to long term success. Howard Insurance LLC bridges the gap between agents, carriers, and industry partners, providing the resources and support you need to grow and thrive in an evolving insurance marketplace. We are able to connect you with top rated carriers in the country so that you can offer your clients the products and services they need and most importantly deserve.

Mark Hunter, CDO, Senior Market Sales

Mark Hunter is Chief Distribution Officer at Senior Market Sales® (SMS), where he leads the Medicare Solutions division. Mark also oversees technology, mergers and acquisitions, and finance to strengthen the company’s value proposition for agents. In addition, Mark plays a role in driving alignment and strategic synergies across the Alliant Consumer Group, part of SMS’ parent company, Alliant Insurance Services. Previously, Mark served as President of Spring Venture Group in Kansas City, directing sales, operations, and technology for one of the industry’s largest Medicare-focused agencies. Mark is a licensed insurance agent, a registered investment advisor, and has passed the FINRA Series 65 exam. A Kansas City native, Mark Hunter graduated cum laude from Harvard University with a degree in American History.

Matt Huray, Chief Growth Officer, InnovAge

Matt brings over 20 years of strategic finance and analytical experience to InnovAge. He most recently held senior leadership roles at Humana, including chief financial officer of the healthcare services segment and enterprise corporate development. Prior to Humana, Matt spent 13 years at Bank of America Merrill Lynch, most recently as a managing director of investment banking for the Global Healthcare Group. While there, he executed advisory assignments and financings within the healthcare services sector. Matt has a Bachelor of Arts in economics from Vanderbilt University and an MBA from the Kellogg School of Management at Northwestern University. He also holds the Chartered Financial Analyst (CFA) designation.

Gabe Isaacson, Chief Strategy Officer, Integrity

As the Chief Strategy Officer of Integrity, Gabe Isaacson leads strategy and execution across the firm’s life, health and wealth distribution platform. He is known for bringing a sharp, analytical approach to solving complex industry challenges and for building teams that deliver lasting impact. Gabe began his career at McKinsey & Company in 2019, where he quickly rose to Partner and co-led the national Medicare practice. Over the next six years, he advised senior leadership at major healthcare organizations and led go-to-market strategies across the senior and government-sponsored markets. Gabe earned both his JD from the University of Pittsburgh School of Law and MBA from Carnegie Mellon’s Tepper School of Business in 2019, after completing his undergraduate studies at Georgetown University in 2015.

Eric Izquierdo, President, InTouch Financial Group

Eric Izquierdo is the President of InTouch Financial Group and a principal leader within 129 Holdings LLC, a diversified holding company spanning insurance distribution, healthcare operations, MSOs, and clinic networks. His career has taken him through every layer of the protection ecosystem — from scaling ACA and Medicare organizations to supporting provider‑side operations that serve thousands of patients — yet his foundation has always been rooted in life insurance.

This blend of life‑first expertise and deep operational experience across health and clinical environments gives Eric a rare vantage point in today’s converging industry. He understands how consumers move, how agencies grow, and how life and annuity solutions can be integrated into health‑driven businesses without disrupting their core momentum. He has built high‑performing teams on both sides of the industry and developed activation models that help agents protect more families while strengthening retention and long‑term revenue.

Today, as the market shifts toward holistic protection, Eric brings all of his experience together to help agencies evolve with clarity, confidence, and a forward‑looking strategy that aligns with where the industry is headed.

Kent Jacquay, Founder, Index Resource Center

I was licensed for life & annuity in 1995. I sold my first Fixed Indexed Annuity in 1997. I also started my wholesaling career in 1997. I have held multiple positions at 7 different marketing organizations and owned my own for almost 10 years. In 2004 I was part of a committee that introduced the first income rider attached to a Fixed Indexed Annuity. I have been tracking the performance history of Fixed Indexed Annuities for over 20 years. In 2019 I founded the Index Resource Center which focuses on the historical performance of indices and crediting methods as it pertains to Fixed Indexed Annuity allocations. In 2024 I invented the mathematical formula called "Retro Pricing" that has changed the way the entire industry looks at historical index back-testing.

Sachin Jain, MD, President & CEO, SCAN Group & SCAN Health Plan

Sachin H. Jain, MD, MBA, is CEO of SCAN Group and SCAN Health Plan, serving over 300,000 members across five states. Previously, he was President and CEO of CareMore and Aspire Health, serving 200,000 patients in 32 states. He has held leadership roles at Merck & Co., CMS, and CMMI. Dr. Jain graduated from Harvard College, Harvard Medical School, and Harvard Business School. He is an Adjunct Professor at Stanford University School of Medicine and serves on the boards of AHIP, Omada Health, Advantage Healthcare Services, and The Paul & Daisy Soros Fellowships for New Americans.

Lauren Jenkins, CEO, Native Oklahoma Insurance

Lauren Jenkins is the President and CEO of Native Oklahoma Insurance, specializing in Marketplace plans since their inception. She actively contributes to agent and broker panels for CMS and has served as an expert panelist supporting underserved and underinsured communities. Lauren volunteers her time on advisory boards for platforms and carriers, working to improve industry standards and streamline enrollment processes for both agents and consumers. An advocate for meaningful change, she engages with legislators in Washington, D.C. and proudly serves as a Presidential Board Member for Health Agents for America (HAFA).

James Jiang, CEO & Co-Founder, Spark Advisors

James Jiang is the CEO and cofounder of Spark, where he leads overall strategy and growth in support of Spark’s mission: to help every Medicare beneficiary take control of his health. James spends his time building deep partnerships with leading independent agencies, providing powerful technology and world-class service to reimagine the agent and client experience. Before Spark, James built value-based in-home care programs for high-need Medicare beneficiaries at Roster Health and worked as an institutional investor in high-growth companies.

Bruce Johnson, Head of Policy, Thatch

Bruce Johnson is Head of Policy at Thatch, a health benefits platform empowering businesses to deliver affordable, personalized healthcare coverage. With fifteen years in law and policy, he previously served as Director, Federal Affairs at Boeing and Assistant General Counsel at Brex, where he also chaired the Financial Technology Association. Bruce’s work earned recognition by Washingtonian magazine as one of DC #39's most influential policy shapers. Bruce formerly served in senior staff roles on the House Financial Services Committee and as an Air Force intelligence officer. He holds a J.D. from Georgetown and a Bachelor of Science from the U.S. Air Force Academy.

Mary Anna Jones, AVP, National Sales Distribution, Wellabe